SR&ED Tax Incentives

Scientific Research and Experimental Development (SR&ED) tax incentives are a business support program administrated by the Government of Canada to encourage businesses to conduct research and development (R&D) in Canada.

As defined in the Income Tax Act, “SR&ED” means systematic investigation or search that is carried out in a field of science or technology by means of experiment or analysis.

An SR&ED project is a set of interrelated activities that together achieve or attempt to achieve scientific or technological advancement. Depending on the purpose of the project, SR&ED can involve:

basic research

basic research

applied research

applied research

experimental development

experimental development

* All information provided on this page was sourced from the Government of Canada website.

OCIP aims to connect businesses and organizations with academic research expertise to undertake R&D projects, which aligns with the fundamental goals of the SR&ED tax incentives program. These collaborative projects may involve activities and expenditures that meet the program criteria, strategically positioning businesses to unlock the potential for substantial tax incentives.

How businesses can benefit

Businesses in Canada can benefit from SR&ED tax incentives in two ways, depending on their size and the nature of their activities:

Claim a deduction against income

Claim a deduction against income

Earn an investment tax credit (ITC) that they can apply against their income tax payable

Earn an investment tax credit (ITC) that they can apply against their income tax payable

The amount of benefits that businesses can earn from SR&ED tax incentives in Canada depends on various factors, including the type of business structure and the qualified SR&ED expenditures they have incurred. Here are some general guidelines for SR&ED ITC rates for various entities:

Canadian-Controlled Private Corporations (CCPCs):

Canadian-Controlled Private Corporations (CCPCs):

- 35% ITC on the first $3 million of qualified expenditures.

- 15% ITC on qualified expenditures over $3 million

Other Corporations:

Other Corporations:

- 15% ITC on qualified expenditures.

Individuals, Partnerships, and Trusts:

Individuals, Partnerships, and Trusts:

- 15% ITC on qualified expenditures.

What type of work is eligible for SR&ED tax incentives

To be eligible for SR&ED tax incentives, your project must be conducted in Canada and meet both of the following requirements:

- The work must be conducted for the advancement of scientific knowledge or for the purpose of achieving a technological advancement.

- The work must be a systematic investigation or search that is carried out in a field of science or technology by means of experiment or analysis.

Eligible types of work include basic research, applied research, experimental development, and support work, while there are types of work that are ineligible and cannot be claimed.

How to check if your project is eligible for SR&ED tax incentives

- Review the eligibility guidelines for SR&ED tax incentives.

- Use the SR&ED Self-Assessment and Learning Tool (SALT) provided by the Government of Canada to determine if your work is eligible and what information you need to complete your claim.

- Request a pre-claim consultation provided by the Government of Canada.

- Contact the coordinating tax services office for your region if you have any questions about the SR&ED program or the eligibility of your work.

When to claim

A claimant’s income tax return filing due date for a tax year is the day the claimant’s income tax return under Part I of the Income Tax Act is required to be filed for the year or would be required to be filed, if tax under Part I of the Act was payable by the claimant.

More information about the filing due date and SR&ED reporting deadlines can be found on the Government of Canada website.

How to claim

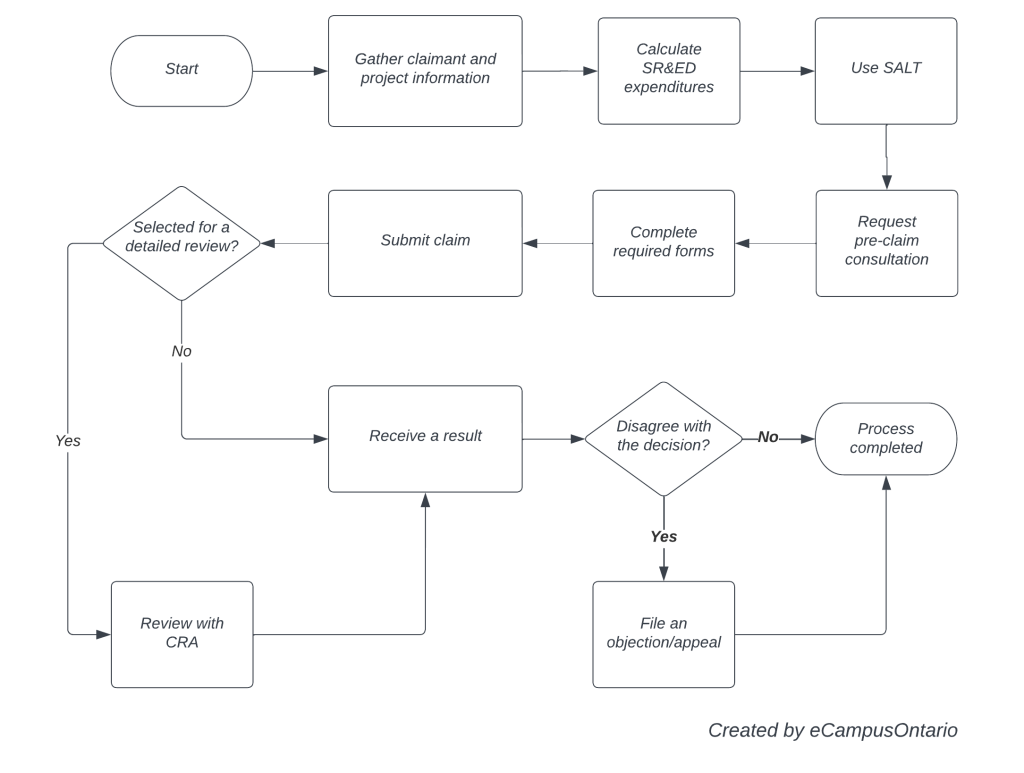

The process map created by eCampusOntario below provides a high-level overview of the SR&ED tax claiming process, utilizing information from the Government of Canada website. It’s important to note that the process may vary based on individual cases. Your unique project may require specific adaptations or additional steps as determined by the Government of Canada.

Step 1: Gather claimant and project information.

Step 2: Calculate SR&ED expenditures for the following items:

- Salary or wages

- Materials

- Contract expenditures

- Overhead and other expenditures

- Third-party payments

Step 3: Use the Self-Assessment & Learning Tool (SALT) to:

- understand if your work may qualify as SR&ED

- estimate the amount of the SR&ED investment tax credit (ITC) that you may be eligible to claim when you file your income tax return

- understand the kinds of information you need to complete a claim before you submit it

- understand the kinds of records you may need to support your claim

Step 4: After completing the self-assessment, you can request pre-claim consultation to identify if there is SR&ED work in any of the projects before you submit a claim for SR&ED tax incentives.

Step 5: To submit a SR&ED claim, you should file an income tax return along with the following forms:

- Form T661, SR&ED Expenditures Claim

- Form T2SCH31 or Form T2038(IND) to claim an ITC

- Other forms, as needed (T1145, T1146, T1174, T1263, and any attachments)

Step 6: Submit completed forms.

Step 7: After you submit the claim, it will be processed and may be selected for a detailed review.

Step 8: If you disagree with the CRA’s decision once the claims has been processed, you can file an objection or an appeal.

Support services & tools

- Contact the coordinating tax services office for your region for any questions regarding SR&ED.

- First-time claimants may be selected to participate in the First-Time Claimant Advisory Service program to receive recommendations and guidance to support future claims.

- The SR&ED Service Visit gives eligible claimants an opportunity to meet with a CRA representative and discuss any aspect of the SR&ED program.

- The SR&ED Outreach program provides education to eligible Canadian businesses that seek growth through innovation.

- SR&ED policies and procedures

- SR&ED webinars